Trending Now

#High Class Fashion low budget

#Employing energy efficiency at home to cut down on bills

#Hiring Air Conditioning Replacement Contractors

#Common types of cbd for sale cbd drops cbd topicals and cbd Capsules

#Now is the Perfect Time to Get a Botox Injection

#Tandoori Chicken recipe

#Merry Christmas Gif is the most significant period of the year

#All about Relion Thermometer

#Jaden Smith Gay – A Complete Story about Life

#Aude legastelois: Death in paradise , bide, Nude and Wiki

Posts Tagged: Kids

- 331 Views

- John

- May 18, 2023

The Importance of Professional Supervision in Ensuring a Productive and Safe Experience with Kid’s Swimming Lessons

Children of all ages enjoy swimming since it is thrilling and entertaining. It not only offers kids a cool respite from the summer heat, but it also promotes a variety of athletic and social abilities

- 352 Views

- John

- March 27, 2023

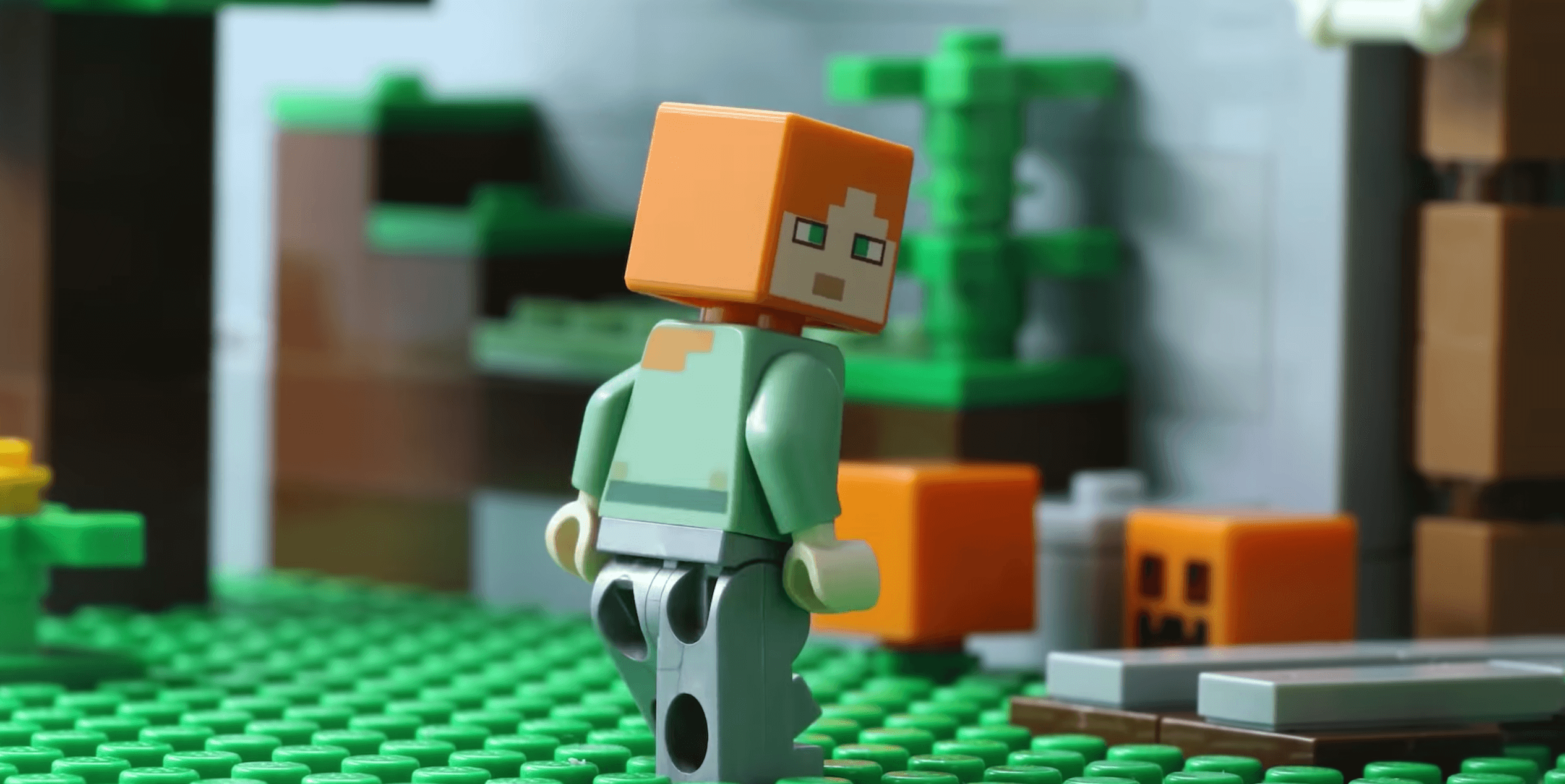

Why Parents Are Raving About Minecraft Toys For Kids

If you’re looking for an excellent gift for your kid, you may want to consider getting Minecraft toys. Not only are these toys great for creative play, but they also provide other benefits that parents