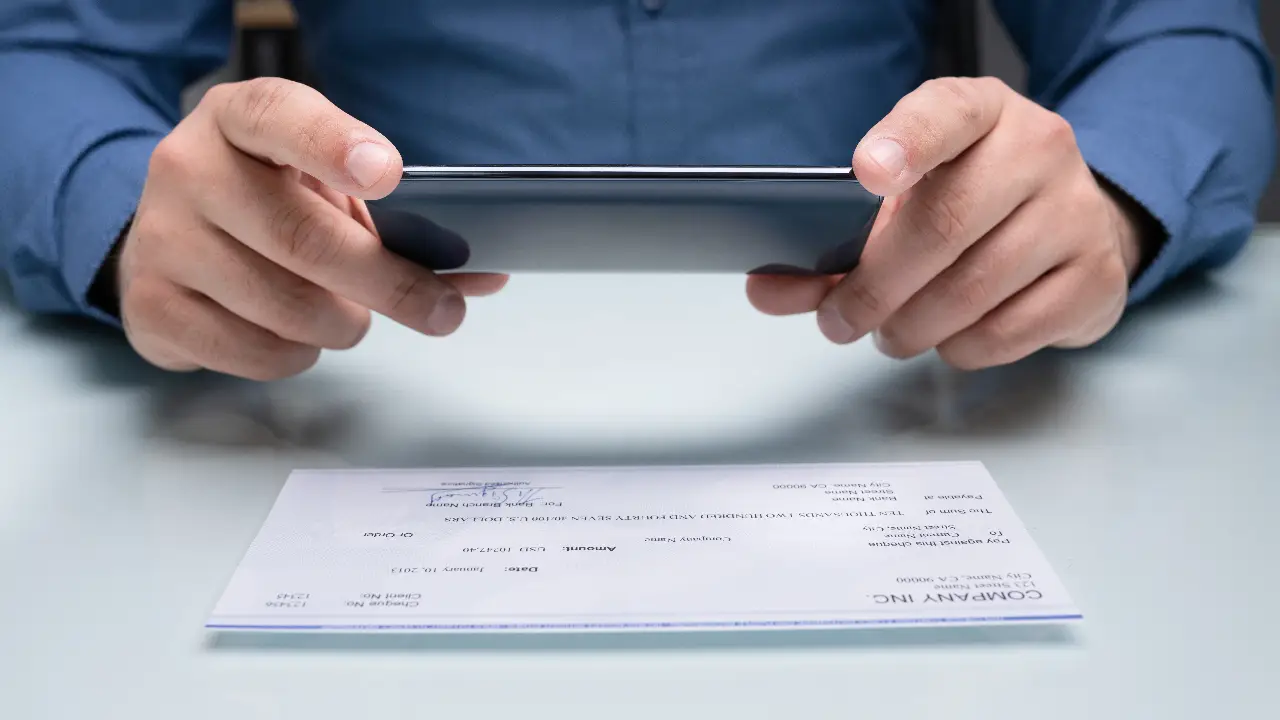

The Convenience of Using Personal Checks Online

If you’re searching for methods to save money, one option is to utilize personal checks online rather than cash. It is a great way to avoid the cost of convenience fees and can also give you a convenient way to get cash without hassle with a traditional bank.

Paying with a check can help avoid Convenience Fees

If you want an alternative to credit cards, consider paying with personal checks online. It will keep you from paying convenience fees, which can add up over time. However, there are some disadvantages to accepting checks.

One disadvantage is the cost of processing and buying checks. Some people can save money by ordering blank checks instead of purchasing personalized ones.

The time it takes to process and deposit checks. Typically, it takes three business days for a check to appear in your account. It can lead to an overdraft if you need more cash. To avoid an overdraft, you can sign up for notifications when your balance is low.

If you are worried about the security of paying with a personal check, you can also use an e-check. An e-check works much like a credit card. An e-check is processed quickly.

They’re a way to Access cash without the Fuss

Getting cash is only sometimes accessible if you have a bank account. If you have a government-issued check, you’ll have luck. It’s common, though, for an extensive check to take a long time to clear. There are a few places you can try before you give up.

One of the easiest and most convenient ways to access cash is to use a prepaid debit card. These are similar to checking accounts in that they let you load money onto a card that can be carried in your wallet or pocket. However, most prepaid cards limit you to a certain amount of money on them, so you’ll need to stay moderate.

You can also visit a check cashing store and see if they will cash the old-fashioned way. These are costly, so make sure you can afford the fees. For the most part, the fees are a flat rate per check. They may also require you to provide some proof of address and will typically require two forms of identification to cash a check.

They’re not Cost-Effective

There are many reasons to use checks for your day-to-day purchases. Unlike debit cards, they offer an added measure of safety. Plus, they’re easier to carry in a wallet than cash.

A personal check may not be the most cost-effective way to get your money where it needs to be. Some businesses charge a convenience fee for electronic payments. Some stores only accept cash.

The best way to order checks is from your bank, but this is only the most obvious option. Alternatively, you could order checks online. It is more expensive but still a reasonable choice. The internet is a great place to find reputable third-party vendors. Buying your checks from a reputable company is the safest way to go.

There’s a reason that checks have been around for centuries. While they do not boast a dazzling array of features, they are a desirable way to get your hands on your hard-earned dough.

They affect your Credit History

Lenders use credit ratings to determine whether you are a financial risk. They’re based on several factors, including the total amount owed, the length of your credit history, and how often you make payments. A strong score opens up more credit options. It also determines your interest rates and financing products.

Positive payment history is considered one of the most critical factors in your credit score. You can improve your score by making timely payments, paying down balances, and avoiding late charges. A high credit utilization ratio can raise a red flag.

Other factors that can negatively affect your credit score include bankruptcy, foreclosures, and charge-offs. Public records such as judgments, liens, and wage attachments are also recorded on your report. If any adverse information is found, it can prevent you from obtaining additional credit or an apartment.

Your lender will conduct a credit check when you apply for a new loan. These checks are known as “hard” inquiries. Hard inquiries stay on your credit report for two years.

Read More: The Best Hair Transplant in Turkey